CHENIERE ENERGY, INC. 2019 PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to | |

Cheniere Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

Notes:

Reg. §240.14a-101.§240.14a-101.

SEC 1913(3-99)

CHENIERE ENERGY, INC. 2019 PROXY STATEMENT

April 15, 2019

To our Shareholders:

It is our pleasure to invite you to attend the Cheniere Energy, Inc. 2019 Annual Meeting of Shareholders. The meeting will be held at 9:00 a.m., Central Time on May 16, 2019 at our corporate headquarters located at 700 Milam Street, Suite 1900, Houston, Texas 77002.

The following Notice of Annual Meeting describes the business to be conducted at the 2019 Annual Meeting of Shareholders. We encourage you to review the materials and vote your shares.

You may vote via the Internet, by telephone, or by submitting your completed proxy card by mail. If you attend the 2019 Annual Meeting of Shareholders, you may vote your shares in person if you are a shareholder of record.

Thank you for your continued support as investors in Cheniere Energy, Inc.

Very Truly Yours,

|  | |||

| G. Andrea Botta | Jack A. Fusco | |||

| Chairman of the Board | President and Chief Executive Officer | |||

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713)375-5000

Notice of Special Meeting of Shareholders

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | ||||||

TIME AND DATE: | 9:00 a.m., Central Time on | |||||

| Cheniere Energy, Inc. | |||||

700 Milam Street, Suite 1900

Houston, Texas

700 Milam Street, Suite 1900

Houston, TX 77002

| ||||||

ITEMS OF BUSINESS: | • To elect ten members of the Board of Directors to hold office for aone-year term expiring at the 2020 Annual Meeting of Shareholders. •To approve, on an advisory andnon-binding basis, the | |||||

2018.

• To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. | ||||||

RECORD DATE: | You can vote if you were a shareholder of record on | |||||

| ||||||

| PROXY VOTING: | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning your proxy card by mail or by voting on the Internet or by telephone. See details under the heading “How do I vote?” | |||||

| We are making this Proxy Statement, including the Notice of | |||||

http://www.cheniere.com/2017SpecialMeeting

By order of the Board of Directors

Sean N. Markowitz

Corporate Secretary

December 20, 2016April 15, 2019

December 20, 2016

To our Shareholders:

It is our pleasure to invite you to attend our 2017 Special Meeting of Shareholders. This past year has been a busy one for Cheniere. Under new leadership, Cheniere has implemented a focused and clarified strategy, adopted comprehensive governance enhancements, appointed a new executive leadership team, and in 2016 delivered significant operating and financial results. Beginning in early 2017, Cheniere intends to transition to a more consistent, competitive, and conventional total compensation philosophy, including equity-based long-term incentive opportunities tied to financial and growth objectives.

We believe that a new long-term incentive program that provides for equity-based awards is a required and critical element of the new compensation philosophy and strategy. Equity grants align our employees’ interests with the interests of shareholders by rewarding long-term value creation. They enable us to attract and retain highly qualified individuals for important positions throughout the Company.

As a result, we are seeking a shareholder vote to approve or not approve the issuance of awards with respect to the 7,845,630 shares of common stock comprising the Available Shares (as defined in Proposal 1). In order to further the Company’s transition and fully implement our new compensation strategy, we are seeking such shareholder approval. Proposal 1 sets forth the required steps and shareholder approval necessary to proceed with our transition. We expect these shares to last approximately 5 years and be used to grant awards to all of our approximately 900 employees.

We encourage you to review these materials and vote your shares. We are proud that you have chosen to invest in Cheniere. On behalf of our management and directors, thank you for your continued support and confidence.

Very truly yours,

Jack A. Fusco

President and Chief Executive Officer

Table of ContentsTABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 26 | ||||

Code of Conduct and Ethics and Corporate Governance Guidelines | 26 | |||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

All Other Compensation included in the Summary Compensation Table | ||||

Narrative to the Summary Compensation & Grants of Plan-Based Awards Tables | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 77 | ||||

Director Nominees for Inclusion in Next Year’s Proxy Statement (Proxy Access) | ||||

| A-1 | ||||

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

| |||||||||

| B-1

| |||||||||

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Cheniere Energy, Inc. (“Cheniere,” the “Company,” “we,” “us” or “our”), a Delaware corporation, of proxies to be voted at our Special Meeting of Shareholders (the “Meeting”) and any adjournment or postponement thereof.

You are invited to attend the Meeting on January 31, 2017, beginning at 9:00 a.m., Central Time. The Meeting will be held at the Company’s headquarters at 700 Milam Street, Suite 1900, Houston, Texas 77002.

This Notice of Special Meeting, Proxy Statement and proxy card, are being mailed to shareholders on or about December 20, 2016.

Do I need a ticket to attend the Meeting?

You will need proof of ownership and valid government-issued picture identification to enter the Meeting.

If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to attend the Meeting, you must present proof of your ownership of Cheniere stock, as of December 14, 2016 (the “Record Date”), such as a bank or brokerage account statement, to be admitted to the Meeting.

If you have any questions about attending the Meeting, you may contact Investor Relations at info@cheniere.com or 713-375-5100.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted at the Meeting.

Who is entitled to vote at the Meeting?

Holders of Cheniere common stock at the close of business on the Record Date are entitled to receive this Notice and to vote their shares at the Meeting. As of the Record Date, there were 234,961,842 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the Meeting.

| C-1 | ||||

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with Cheniere’s transfer agent, Computershare Trust Company, N.A., you are considered the “shareholder of record” of those shares. The Notice of Special Meeting, Proxy Statement and proxy card have been sent directly to you by Cheniere. If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of such shares held in street name. The Notice of Special Meeting, Proxy Statement and proxy card have been forwarded to you by your broker, bank or other holder of record, who is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or on the Internet.

How do I vote?

You may vote using any of the following methods:

By mail

You may submit your proxy vote by mail by signing a proxy card if your shares are registered or, for shares held beneficially in street name, by following the voting instructions included by your broker, trustee or nominee, and mailing it in the enclosed envelope. If you provide specific voting instructions, your shares will be voted as you have instructed. If you do not indicate your voting preferences, your shares will be voted as recommended by the Board; provided, however, if you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on the following proposal if your bank, broker or other holder of record does not receive voting instructions from you: Proposal 1 to approve the issuance of awards with respect to 7,845,630 shares of common stock available for issuance under the Cheniere Energy, Inc. 2011 Incentive Plan, as amended.

By telephone or on the Internet

If you have telephone or Internet access, you may submit your proxy vote by following the instructions provided on your proxy card or voting instruction form. If you are a beneficial owner, the availability of telephone and Internet voting will depend on the voting processes of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions in the materials you receive.

In person at the Meeting

If you are the shareholder of record, you have the right to vote in person at the Meeting. If you are the beneficial owner, you are also invited to attend the Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Meeting unless you obtain a “legal proxy” from your broker, bank or other holder of record that holds your shares, giving you the right to vote the shares at the Meeting.

Can I revoke my proxy?

If you are a shareholder of record, you can revoke your proxy before it is exercised by:

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the Meeting if you obtain a legal proxy as described in the answer to the preceding question.

Who will receive a proxy card?

If you are a shareholder of record, you will receive a proxy card for the shares you hold in certificate form or in book-entry form. If you are a beneficial owner, you will receive voting instructions from your bank, broker or other holder of record.

Is there a list of shareholders entitled to vote at the Meeting?

The names of shareholders of record entitled to vote at the Meeting will be available at the Meeting and for ten days prior to the Meeting for any purpose germane to the Meeting. The list will be available between the hours of 8:30 a.m. and 4:30 p.m., Central Time, at our offices at 700 Milam Street, Suite 1900, Houston, Texas 77002, by contacting the Corporate Secretary of the Company.

What are the voting requirements to approve the proposal discussed in this Proxy Statement?

The presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of common stock entitled to vote at the Meeting is necessary to constitute a quorum. In the absence of a quorum at the Meeting, the Meeting may be adjourned from time to time without notice, other than an announcement at the Meeting, until a quorum shall be present. Abstentions and “broker non-votes” represented by submitted proxies will be included in the calculation of the number of the shares present at the Meeting for purposes of determining a quorum. “Broker non-votes” occur when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

Proposal 1—To be approved, Proposal 1 to approve the issuance of awards with respect to 7,845,630 shares of common stock available for issuance under the Cheniere Energy, Inc. 2011 Incentive Plan, as amended must receive the approval of a majority of the shares present and entitled to vote on the proposal, meaning that the number of votes “for” Proposal 1 must exceed the number of votes “against” it. Abstentions will be counted as the functional equivalent of “no” votes and broker non-votes will not be considered in determining the outcome of Proposal 1, but will be counted for purposes of establishing a quorum. If you are a beneficial owner, your bank, broker or other holder of record may not vote your shares with respect to Proposal 1 without specific instructions from you because Proposal 1 is not considered a “routine” matter.

Could other matters be decided at the Meeting?

As of the date of this Proxy Statement, we do not know of any matters to be raised at the Meeting other than those referred to in this Proxy Statement. If other matters are properly presented for consideration at the Meeting, the persons named in your proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay for the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. We have hired D. F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, to solicit proxies. We will pay D.F. King a fee of $12,500 plus expenses for these services.

Who will count the vote?

Broadridge Financial Solutions, Inc., an independent third party, will tabulate the votes.

Important NoticeNote Regarding the Availability of Proxy Materials for the Special Meeting to be held on January 31, 2017

The Proxy Statement, including the Notice of Special Meeting, is available on our website athttp://www.cheniere.com/2017SpecialMeeting. Please note that the Notice of Special Meeting is not a form for voting, and presents only an overview of the more complete proxy materials, which contain important information and are available on the Internet or by mail. We encourage our shareholders to access and review the proxy materials before voting.

NOTE REGARDING FORWARD-LOOKING STATEMENTSForward-Looking Statements

This Proxy Statement contains forward-looking statements relating to, among other things, business strategy, performance and expectations for project development. The reader is cautioned not to place undue reliance on these statements and should review the sections captioned “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form10-K for important information about these statements, including the risks, uncertainties and other factors that could cause actual results to vary materially from the assumptions, expectations and projections expressed in any forward-looking statements. These forward-looking statements speak only as of the date made, and, other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise.

The following is an overview of information that you will find throughout this Proxy Statement, but does not contain all of the information that you should consider. For more complete information about these topics, please review the complete Proxy Statement prior to voting.

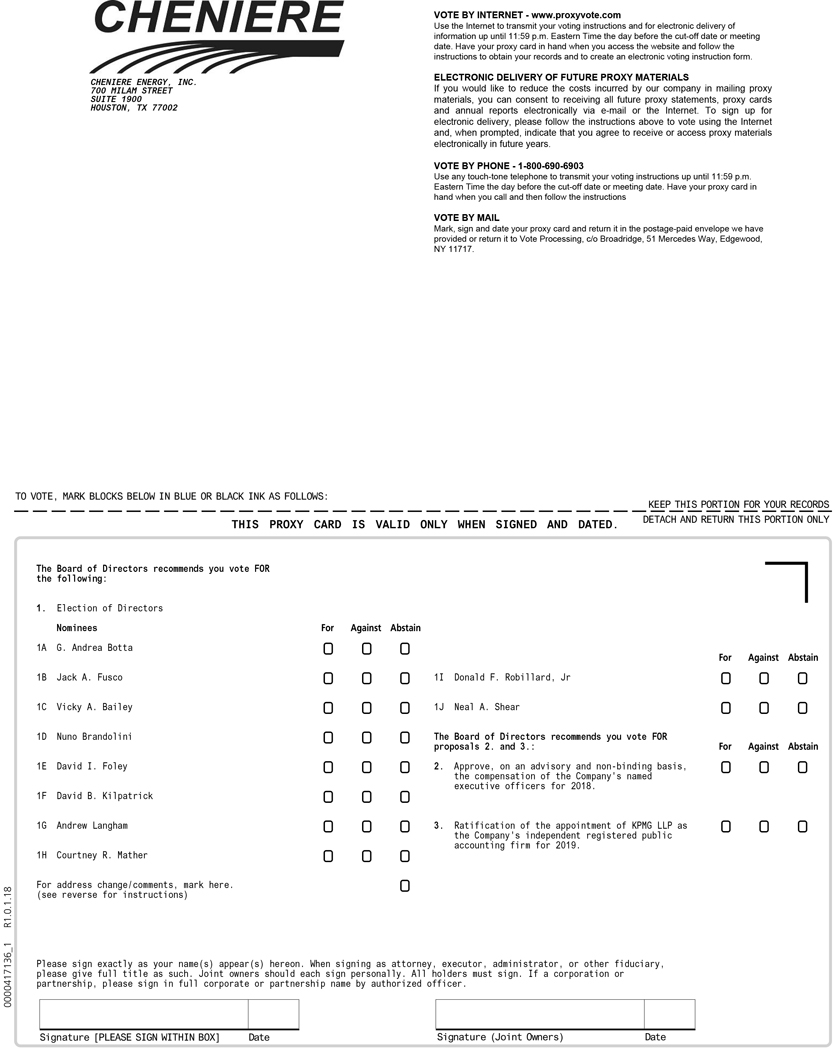

ANNUAL MEETING OF SHAREHOLDERS | ||||||||

| TIME AND DATE: | 9:00 a.m., Central Time on May 16, 2019 | ||||||

| PLACE: | Cheniere Energy, Inc. 700 Milam Street, Suite 1900 Houston, TX 77002 | ||||||

| RECORD DATE: | April 1, 2019 (the “Record Date”) | ||||||

| VOTING: | Shareholders as of the close of business on the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted upon. | ||||||

| ADMISSION: | No admission card is required to enter the Cheniere Energy, Inc. (“Cheniere,” the “Company,” “we,” “us” or “our”) 2019 Annual Meeting of Shareholders (the “Meeting”), but you will need proof of your stock ownership and valid government-issued picture identification. Please see “Frequently Asked Questions” on page 73 of this Proxy Statement for more information. | ||||||

VOTING MATTERS AND BOARD RECOMMENDATIONS

PROPOSAL

| DESCRIPTION

| BOARD VOTE RECOMMENDATION

| PAGE REFERENCE (FOR MORE DETAILS) | |||

1 | Election of directors | FOR EACH NOMINEE | 8 | |||

2 | Advisory andnon-binding vote on the compensation of the Company’s named executive officers for 2018 |

FOR |

68 | |||

3 | Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2019 |

FOR |

70 | |||

| 2019 PROXY STATEMENT | 1 | |||

PROXY SUMMARY

STRATEGIC ACCOMPLISHMENTS

The following items highlight our 2018 and recent accomplishments. For more information about these accomplishments and their relationship to our executive compensation program, please see “Compensation Discussion and Analysis” on page 34 of this Proxy Statement.

| Final investment decision with respect toCorpus Christi Train 3 | Signedlong-term SPAs for~7.5 MTPA of LNG | Record financial results:revenue of~$8 billion, net income ofover $470 million and Consolidated Adjusted EBITDA ofover $2.6 billion | Over270 cargoes exported in 2018 totaling~1 TCF of LNG | |||||||||

Strategic

In November 2018, we entered into an engineering, procurement and construction (“EPC”) contract with Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) for Train 6 of the natural gas liquefaction and export facilities at the Sabine Pass LNG terminal in Louisiana (the “SPL Project”). We also issued limited notices to proceed to Bechtel to commence early engineering, procurement and site works.

In May 2018, our Board made a positive final investment decision (“FID”) with respect to Train 3 of the natural gas liquefaction and export facility at the Corpus Christi LNG terminal (the “CCL Project”) and issued a full notice to proceed to Bechtel under the EPC contract for Train 3.

In June 2018, we filed an application with the Federal Energy Regulatory Commission with respect to Corpus Christi Stage 3, consisting of seven midscale liquefaction Trains with an expected aggregate nominal production capacity of approximately 9.5 million tonnes per annum (“mtpa”) and one liquefied natural gas (“LNG”) storage tank.

In 2018, we signed seven long-term sale and purchase agreements (“SPAs”) with six creditworthy counterparties totaling approximately 7.5 mtpa of LNG.

Operational

As of February 20, 2019, over 575 cumulative LNG cargoes have been produced, loaded and exported from the SPL Project and the CCL Project, with more than 270 cargoes in 2018 alone from the SPL Project, with deliveries to 32 countries and regions worldwide.

In November 2018 and December 2018, we commenced production and shipment of LNG commissioning cargoes from Train 5 of the SPL Project and Train 1 of the CCL Project, respectively, leading to the substantial completion of Train 1 of the CCL Project in February 2019 and Train 5 of the SPL Project in March 2019.

For full year 2018, over 23 million hours of labor were completed with a Lost Time Incident Rate of approximately 0.01. This achievement places us within the top quartile of benchmark metrics published by the Bureau of Labor Statistics for North American Industry Classification (NAICS) codes that align with our work activities.

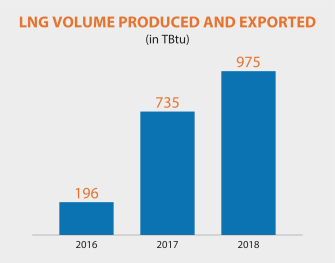

For full year 2018, a total of approximately 975 TBtu of LNG was exported from the SPL Project and the CCL Project, which was approximately 87% of all LNG exported from the United States.

Financial

For full year 2018, we achieved record results in multiple key financial metrics, including net income attributable to common stockholders of over $470 million, consolidated revenues of approximately $8 billion and Consolidated Adjusted EBITDA of over $2.6 billion. For a definition of Consolidated Adjusted EBITDA and a reconciliation of thisnon-GAAP measure to net income, the most directly comparable GAAP financial measure, please see Appendix C.

During 2018, our stock price increased by approximately 10% and outperformed the S&P 500 Index by approximately 15%. Additionally, the total enterprise value of the Company increased by approximately 12%.

| 2 | CHENIERE | |||

2018 PERFORMANCE AND STRATEGIC ACCOMPLISHMENTS

In September 2018, we closed the previously announced merger of Cheniere Energy Partners LP Holdings, LLC (“Cheniere Holdings”) with our wholly owned subsidiary.

We reached the following contractual milestones:

| ○ | In June 2018, the date of first commercial delivery was reached under the20-year SPA with BG Gulf Coast LNG, LLC relating to Train 3 of the SPL Project. |

| ○ | In March 2018, the date of first commercial delivery was reached under the20-year SPA with GAIL (India) Limited relating to Train 4 of the SPL Project. |

| 2019 PROXY STATEMENT | 3 | |||

PROXY SUMMARY

We are committed to the values of effective corporate governance and high ethical standards. Our Board of Directors (the “Board”) believes that these values are conducive to strong performance and creating long-term shareholder value. Our governance framework gives our highly experienced directors the structure necessary to provide oversight, advice and counsel to Cheniere.

Since our 2017 Annual Meeting, we have taken the following governance actions:

engaged with more than 50% of our shareholders each year regarding governance matters;

added additional details regarding the experience of our directors to our proxy statements;

increased our director ownership guidelines; and

adoptednon-employee director equity compensation limits.

The “Governance Information” section of this Proxy Statement, beginning on page 17, describes our corporate governance structure and policies, which include the following:

Board Independence | • 8 out of 10 of our current directors and director nominees are independent. • Independent directors meet regularly without management present. • Our President and CEO is the only management director. | |

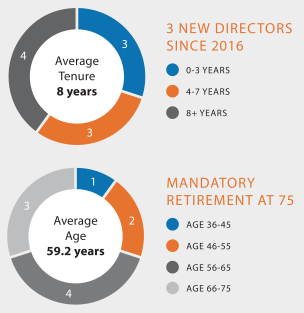

| Board Composition | • The Board consists of 10 directors, with an average age of 59 (as of May 16, 2019). • The Board values diversity and experience in assessing its composition. | |

| Board Performance | • The Board regularly assesses its performance through Board and committee self-evaluations. | |

| Board Committees | • We have three standing Board committees—Audit, Governance and Nominating and Compensation. • All of our Board committees are comprised of and chaired solely by independent directors. | |

| Leadership Structure | • Our Chairman of the Board and CEO roles were split in December 2015. • Our independentNon-Executive Chairman of the Board provides leadership to the Board and ensures that the Board operates independently of management. | |

| Risk Oversight | • The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board review the risks that are within their areas of responsibility. | |

| Open Communication | • We encourage open communication and strong working relationships among theNon-Executive Chairman of the Board and other directors. • Our directors have access to management and employees. | |

Director and Executive Stock Ownership | • We have had rigorous stock ownership guidelines for our directors and executive officers since 2008 and amended our stock ownership guidelines for our directors in February 2017 to make them more rigorous. | |

Director Compensation Limit | • We have capped the annual ordinary course equity award that may be granted to anon-employee director at $495,000 per calendar year. Please see "Director Compensation" on pages 27-28 of this Proxy Statement. | |

Accountability to Shareholders | • Directors are elected annually by a majority of the votes cast with respect to such director. • The Board maintains a process for shareholders to communicate with the Board. • We conduct an annual advisorysay-on-pay vote. • A shareholder, or a group of up to 20 shareholders, owning at least 3% of our common stock for at least the prior 3 consecutive years (and meeting certain other requirements) have the ability to nominate up to 20% of the number of directors serving on our Board (proxy access). | |

Management Succession Planning | • The Governance and Nominating Committee has oversight of succession planning, both planned and emergency. | |

| Governance Policies | • Directors are required to retire at age 75. • We maintain codes of conduct for directors, officers and employees. • We do not allow pledging of Company stock as collateral for a loan or holding Company stock in margin accounts. • We do not allow hedging or short sales of Company stock. • We do not have a shareholder rights plan, or “poison pill”. | |

| 4 | ||||

OUR DIRECTOR NOMINEES

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the 10 director nominees listed below. Each director is elected annually by a majority of the votes cast. Detailed information about each nominee, including background, skills and expertise, can be found in “Proposal 1 – Election of Directors” beginning on page 8.

| NAME

| AGE (AS OF MAY 16, 2019)

| DIRECTOR SINCE

| PRINCIPAL OCCUPATION

| |||

| G. Andrea Botta | 65 | 2010 | Chairman of the Board, Cheniere Energy, Inc.; President, Glenco LLC | |||

| Jack A. Fusco | 56 | 2016 | President and Chief Executive Officer, Cheniere Energy, Inc. | |||

| Vicky A. Bailey | 67 | 2006 | President, Anderson Stratton International, LLC | |||

| Nuno Brandolini | 65 | 2000 | Former General Partner, Scorpion Capital Partners, L.P. | |||

| David I. Foley | 51 | 2012 | Senior Managing Director, The Blackstone Group L.P.; Chief Executive Officer, Blackstone Energy Partners L.P. | |||

| David B. Kilpatrick | 69 | 2003 | President, Kilpatrick Energy Group | |||

| Andrew Langham | 46 | 2017 | General Counsel, Icahn Enterprises L.P. | |||

| Courtney R. Mather | 42 | 2018 | Portfolio Manager of Icahn Capital | |||

| Donald F. Robillard, Jr. | 67 | 2014 | Former Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. and Former Chief Executive Officer and Chairman, ES Xplore, LLC | |||

Neal A. Shear | 64 | 2014 | Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP |

Each director nominee attended or participated in at least 75% of the aggregate number of all meetings of the Board and of each committee on which he or she sits for which the director was eligible to attend in 2018.

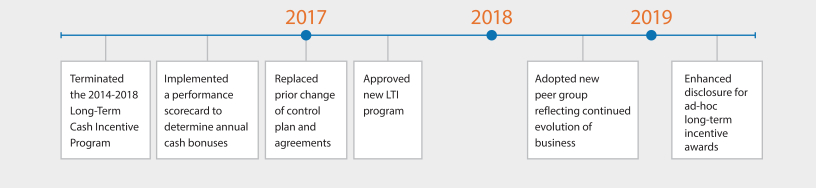

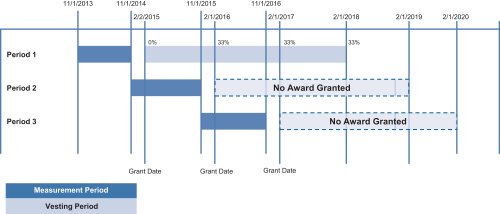

EXECUTIVE COMPENSATION HIGHLIGHTS

In late 2016 and early 2017, our leadership team and Compensation Committee considered input from our shareholders regarding executive compensation. As a result, we implemented several fundamental changes to our executive compensation program to align with our peer group at the time, which focused on our national industry classification – natural gas storage and transportation – and included a number of regulated utilities and smaller pipeline companies. As a result of our growth from a development company into a top tier LNG operator and receipt of shareholder feedback, the Compensation Committee, together with Meridian Compensation Partners, its independent compensation consultant, has further refined the framework of our executive compensation program for 2019. Our achievements and success over the past several years led to a realignment with a new peer group for 2019, and we have reassessed our compensation framework to be consistent with our new peer group and more closely align with our share price performance. Our new program contemplates awarding all compensation within the designed framework of the approved plan, rather than featuringad-hoc grants that can lead to significant variation in year over year compensation. We believe these changes align our program with competitive ranges in our new peer group and take into account the shareholder feedback that we have received.

Compensation Governance Practices

Clear, direct link between pay and performance

Majority of incentive awards earned based on performance

No hedging or “short sales” of Company stock

No pledging of Company stock as collateral for a loan or holding Company stock in margin accounts

| 2019 PROXY STATEMENT | 5 | |||

PROXY SUMMARY

Robust stock ownership guidelines

No defined benefit retirement plan or supplemental executive retirement plan

Robust compensation risk management program

Non-employee director equity compensation limits

Minimum vesting schedule for long-term incentive awards of at least 12 months, subject to limited exceptions

No material perquisites

Solicit annual advisory vote on executive compensation

Annually review the independence of the compensation consultant retained by the Compensation Committee

Philosophy and Objectives

The Board and the Compensation Committee are committed to apay-for-performance compensation structure that aligns our executive compensation with the key drivers of long-term growth and creation of shareholder value, including:

Annual and long-term incentive awards are primarily performance-based

Annual incentive awards earned are based on achievement of specific financial, operating, construction, safety and strategic goals

A significant portion of long-term incentive awards earned is based on financial performance and growth metrics

Equity-based compensation delivers annual, market-competitive opportunities within common norms of shareholder dilution and value creation

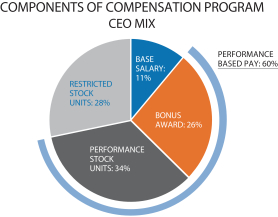

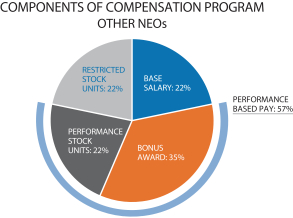

Executive Compensation Components

The primary components of our executive compensation program, as applied to our 2018 Named Executive Officers, are as follows:

TYPE | PURPOSE | PAGE REFERENCE | ||

Base Salary | Provide a minimum, fixed level of | 42 | ||

Annual Incentive Program | Drive achievement of annual corporate goals including key financial, operating, construction, safety and strategic goals that create value for shareholders. | 43 | ||

LTI Program | Align executive officers’ interests with the interests of shareholders by rewarding sustained financial performance and growth through a multi-year performance period. | 45 | ||

Post-Employment Compensation | Assist executive officers and other eligible employees to prepare financially for retirement, to offer benefits that are competitive andtax-efficient and to provide a benefits structure that allows for reasonable certainty of future costs. Help retain executive officers and certain other qualified employees, maintain a stable work environment and provide financial security in the event of achange-in-control or in the event of an involuntary termination of employment. | 49-51 | ||

| 6 | CHENIERE | |||

RATIFICATION OF KPMG AS AUDITOR FOR 2019

RATIFICATION OF KPMG AS AUDITOR FOR 2019

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for 2019. The following table sets forth the fees billed to us by KPMG for professional services for 2018 and 2017.

| 2018 | 2017 | |||||||

Audit Fees | $ | 6,663,332 | $ | 6,954,381 | ||||

Audit Related Fees | $ | — | $ | — | ||||

Tax Fees | $ | 196,480 | $ | 88,565 | ||||

All Other Fees | $ | 2,430 | $ | 80,570 | ||||

Total | $ | 6,862,242 | $ | 7,123,516 |

See “Report of the Audit Committee” on page 69 and the information provided in Proposal 3, beginning on page 70, for more details.

| 2019 PROXY STATEMENT | 7 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

This year, there are 10 nominees standing for election as directors at the Meeting. Below is a summary of our director nominees, including their committee memberships as of April 15, 2019. The Board, with assistance from the Governance and Nominating Committee, will evaluate and reassign committee memberships as needed following the Meeting and election of the director nominees. Detailed information about each director’s background, skills and expertise is provided below.

| NOMINEE COMMITTEE MEMBERSHIPS | ||||||||||||||||||

NAME CURRENT POSITION | AGE (AS OF MAY 16, 2019) | DIRECTOR SINCE | INDEPENDENT | AUDIT | GOVERNANCE AND NOMINATING | COMPENSATION | ||||||||||||

G. Andrea Botta Chairman of the Board, Cheniere Energy, Inc. President, Glenco LLC | 65 | 2010 | YES | Chair | ||||||||||||||

Jack A. Fusco President and Chief Executive Officer, Cheniere Energy, Inc. | 56 | 2016 | NO | |||||||||||||||

Vicky A. Bailey President, Anderson Stratton International, LLC | 67 | 2006 | YES | ● | ● | |||||||||||||

Nuno Brandolini Former General Partner, Scorpion Capital Partners, L.P. | 65 | 2000 | YES | ● | ● | |||||||||||||

David I. Foley Senior Managing Director, The Blackstone Group L.P. Chief Executive Officer, Blackstone Energy Partners L.P. | 51 | 2012 | NO | |||||||||||||||

David B. Kilpatrick President, Kilpatrick Energy Group | 69 | 2003 | YES | ● | ● | |||||||||||||

Andrew Langham General Counsel, Icahn Enterprises L.P. | 46 | 2017 | YES | ● | ● | |||||||||||||

Courtney R. Mather Portfolio Manager of Icahn Capital | 42 | 2018 | YES | ● F | ||||||||||||||

Donald F. Robillard, Jr. Former Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. and Former Chief Executive Officer and Chairman, ES Xplore, LLC | 67 | 2014 | YES | Chair; F | ||||||||||||||

Neal A. Shear Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP | 64 | 2014 | YES | Chair | ||||||||||||||

F Audit Committee Financial Expert

The Board has determined that each of Messrs. Mather and Robillard is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

| 8 | CHENIERE | |||

DIRECTORS AND NOMINEES

Summary of Director Core Competencies

The following chart summarizes the core competencies of our director nominees.

SNAPSHOT OF 2019 DIRECTOR NOMINEES

Our director nominees complement each other to create

a well-rounded boardroom, and each adds:

A deep commitment to stewardship

A proven record of success

Unique and valuable insight

International industry experience

There are 10 nominees standing for election as directors at the Meeting. Each nominee, if elected, will hold office for aone-year term expiring at the 2020 Annual Meeting of Shareholders and will serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Each of the director nominees has consented to serve as a director if elected orre-elected.

Each of the director nominees currently serves on the Board. Directors are elected by a majority of votes cast with respect to such director nominee. Unless your proxy specifies otherwise, it is intended that the shares represented by your proxy will be voted for the election of these 10 nominees. If you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on Proposal 1 to elect directors if the bank, broker or other holder of record does not receive specific voting instructions from you. Proxies cannot be voted for a greater number of persons than the number of nominees named. The Board is unaware of any circumstances likely to render any nominee unavailable.

The Board recommends a voteFOR the election of the 10 nominees as directors of the Company to hold office for aone-year term expiring at the 2020 Annual Meeting of Shareholders or until their successors are duly elected and qualified.

| 2019 PROXY STATEMENT | 9 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR NOMINATIONS AND QUALIFICATIONS

Director Nomination Policy and Procedures. Our Director Nomination Policy and Procedures is attached to the Governance and Nominating Committee’s written charter as Exhibit A, which is available on our website atwww.cheniere.com. The Governance and Nominating Committee considers suggestions for potential director nominees to the Board from any source, including current members of the Board and our management, advisors and shareholders. The Governance and Nominating Committee evaluates potential nominees by reviewing their qualifications and any other information deemed relevant. Director nominees are recommended to the Board by the Governance and Nominating Committee.

The full Board will select and recommend candidates for nomination as directors for shareholders to consider and vote upon at the annual shareholders’ meeting. The Governance and Nominating Committee reviews and considers any candidates submitted by a shareholder or shareholder group in the same manner as all other candidates.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. However, minimum criteria for selection of members to serve on our Board include the following:

highest professional and personal ethical standards and integrity;

high level of education and/or business experience;

broad-based business acumen;

understanding of the Company’s business and industry;

sufficient time to effectively carry out their duties;

strategic thinking and willingness to share ideas;

loyalty and commitment to driving the success of the Company;

network of business and industry contacts; and

diversity of experiences, expertise and backgrounds among members of the Board.

Director Search. We have engaged an independent director search firm to help identify prospective director candidates, with the goal of adding one director to our Board in 2019. In addition to the minimum criteria described above, the Governance and Nominating Committee is evaluating the skill sets needed to maximize Board effectiveness and support the strategic direction of the Company. We will look at a diverse pool of candidates, considering each candidate’s business or professional experience, demonstrated leadership ability, integrity and judgment, record of public service, diversity, financial and technological acumen and international experience. We view and define diversity in a broad sense, which includes gender, ethnicity, age, education, experience and leadership qualities.

Practices for Considering Diversity. The minimum criteria for selection of members to serve on our Board are designed to ensure that the Governance and Nominating Committee selects director nominees taking into consideration that the Board will benefit from having directors that represent a diversity of experience and backgrounds. Director nominees are selected so that the Board represents a diversity of experience in areas needed to foster the Company’s business success, including experience in the energy industry, finance, consulting, international affairs, public service, governance and regulatory compliance. Each year the Board and each committee participates in a self-assessment or evaluation of the effectiveness of the Board and its committees. These evaluations assess the diversity of talents, expertise and occupational and personal backgrounds of the Board members.

Shareholder Nominations for Director. A shareholder of the Company may nominate a candidate or candidates for election to the Board if such shareholder (1) was a shareholder of record at the time the notice provided for below is delivered to the Corporate Secretary, (2) is entitled to vote at the meeting of shareholders called for the election of directors and is entitled to vote upon such election and (3) complies with the notice procedures set forth in our Bylaws. Nominations made by a shareholder must be made by giving timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely, a shareholder’s notice must be delivered not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual meeting. However, if (and only if) the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting

| 10 | CHENIERE | |||

DIRECTOR NOMINATIONS AND QUALIFICATIONS

or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. In no event will the public announcement of an adjournment or postponement of an annual meeting of shareholders commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. A shareholder’s notice must include information about the shareholder and the nominee, as required by our Bylaws, which are available on our website atwww.cheniere.com.

Director Nominations for Inclusion in Proxy Statement (Proxy Access).A shareholder, or group of up to 20 shareholders, owning at least 3% of the Company’s common stock for at least the prior three consecutive years (and meeting the other requirements set forth in our Bylaws) may nominate for election to our Board and inclusion in our proxy statement for our annual meeting of shareholders up to 20% of the number of directors serving on our Board. In September 2016, the Board amended the Company’s proxy access bylaw to (i) expand the definition of Eligible Holder to specifically allow groups of funds under common management and funded primarily by the same employer to be treated as one Eligible Holder, (ii) clarify the timing required for a shareholder to propose a director nominee and (iii) eliminate the provision that allowed the Company to omit from its Proxy Statement a director nominee who receives a vote of less than 25% of the shares of common stock entitled to vote for such nominee at one of the two preceding annual meetings.

Notice must include all information formally stated in our Bylaws, which is available on our website atwww.cheniere.com. In addition to complying with the other requirements set forth in our Bylaws, an eligible shareholder must provide timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely for purposes of proxy access, a shareholder’s notice must be delivered not later than the close of business on the 120th day, nor earlier than the close of business on the 150th day, prior to the first anniversary of the date that the Company first mailed its proxy statement to shareholders for the prior year’s annual meeting of shareholders. However, if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends 30 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), notice must be given in the manner provided in our Bylaws by the later of the close of business on the date that is 180 days prior to such Other Meeting Date and the 10th day following the date on which public announcement of such Other Meeting Date is first made.

Director Qualifications. The Board has concluded that, in light of our business and structure, each of our director nominees possesses relevant experience, qualifications, attributes and skills and should continue to serve on our Board as of the date of this Proxy Statement. The primary qualifications of our directors are further discussed under “Director Biographies” below.

Director Retirement Policy. The Board has adopted a mandatory director retirement policy that requires each director who has attained the age of 75 to retire from the Board at the annual meeting of shareholders of the Company held in the year in which his or her current term expires, unless the Board determines such mandate for a particular director is not at the time in the best interests of the Company. The Board believes this policy will ensure a healthy rotation of directors, which will promote the continued influx of new ideas and perspectives to the Board.

| 2019 PROXY STATEMENT | 11 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

JACK A . FUSCO PRESIDENT & CEO | AGE:56 DIRECTOR SINCE: JUNE 2016 | |||||

Jack A. Fusco is a director and the President and Chief Executive Officer of Cheniere. Mr. Fusco has served as President and Chief Executive Officer since May 2016 and as a director since June 2016. In addition, Mr. Fusco serves as Chairman, President and Chief Executive Officer of Cheniere Energy Partners GP, LLC, a wholly-owned subsidiary of Cheniere and the general partner of Cheniere Energy Partners, L.P. (”Cheniere Partners”) a publicly-traded limited partnership that is operating the Sabine Pass LNG terminal. Mr. Fusco served as Chairman, President and Chief Executive Officer of Cheniere Holdings from June 2016 to September 2018. Mr. Fusco is also a Manager, President and Chief Executive Officer of the general partner of Sabine Pass LNG, L.P. and Chief Executive Officer of Sabine Pass Liquefaction, LLC. Mr. Fusco received recognition as Best CEO in the electric industry by Institutional Investor in 2012 as ranked by all industry analysts and for Best Investor Relations by a CEO or Chairman among allmid-cap companies by IR Magazine in 2013.

Mr. Fusco served as Chief Executive Officer of Calpine Corporation (“Calpine”) from August 2008 to May 2014 and as Executive Chairman of Calpine from May 2014 through May 11, 2016. Mr. Fusco served as a member of the board of directors of Calpine from August 2008 until March 2018, when the sale of Calpine to an affiliate of Energy Capital Partners and a consortium of other investors was completed. Mr. Fusco was recruited by Calpine’s key shareholders in 2008, just as that company was emerging from bankruptcy. Calpine grew to become America’s largest generator of electricity from natural gas, safely and reliably meeting the needs of an economy that demands cleaner, more fuel-efficient and dependable sources of electricity. As Chief Executive Officer of

Calpine, Mr. Fusco managed a team of approximately 2,300 employees and led one of the largest purchasers of natural gas in America, a successful developer of newgas-fired power generation facilities and a company that prudently managed the inherent commodity trading and balance sheet risks associated with being a merchant power producer.

Mr. Fusco’s career of over 30 years in the energy industry began with his employment at Pacific Gas & Electric Company upon graduation from California State University, Sacramento with a Bachelor of Science in Mechanical Engineering in 1984. He joined Goldman Sachs 13 years later as a Vice President with responsibility for commodity trading and marketing of wholesale electricity, a role that led to the creation of Orion Power Holdings, an independent power producer that Mr. Fusco helped found with backing from Goldman Sachs, where he served as President and Chief Executive Officer from 1998-2002. In 2004, he was asked to serve as Chairman and Chief Executive Officer of Texas Genco LLC by a group of private institutional investors, and successfully managed the transition of that business from a subsidiary of a regulated utility to a strong and profitable independent company, generating a more than5-fold return for shareholders upon its merger with NRG in 2006.

Skills and Qualifications:

Mr. Fusco brings his prior experience leading successful energy industry companies and his perspective as President and Chief Executive Officer of Cheniere.

G . ANDREA BOTTA CHAIRMAN OF THE BOARD AND CHAIRMAN OF GOVERNANCE AND NOMINATING COMMITTEE | AGE:65 DIRECTOR SINCE: 2010 | |||||

G. Andrea Botta is the Chairman of the Board and Chairman of our Governance and Nominating Committee. Mr. Botta has served as President of Glenco LLC (“Glenco”), a private investment company, since February 2006. Prior to joining Glenco, Mr. Botta served as Managing Director of Morgan Stanley from 1999 to February 2006. Before joining Morgan Stanley, he was President of EXOR America, Inc. (formerlyIFINT-USA, Inc.) from 1993 until September 1999 and for more than five years prior thereto, Vice President of Acquisitions of

IFINT-USA, Inc. From March 2008 until February 2018, Mr. Botta served on the board of directors of Graphic Packaging Holding Company. Mr. Botta earned a degree in Economics and Business Administration from the University of Torino in 1976.

Skills and Qualifications:

Mr. Botta brings a unique international perspective to our Board and significant investing expertise. He has over 30 years of investing experience primarily in private equity investing.

| 12 | CHENIERE | |||

DIRECTOR BIOGRAPHIES

VICKY A . BAILEY MEMBER OF AUDIT COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE | AGE:67 DIRECTOR SINCE: 2006 | |||||

Vicky A. Bailey is a member of our Audit Committee and Governance and Nominating Committee. Since November 2005, Ms. Bailey has been President of Anderson Stratton International, LLC, a strategic consulting and government relations company in Washington, D.C. She was a partner with Johnston & Associates, LLC, a public relations firm in Washington, D.C., from March 2004 through October 2006. Prior to joining Johnston & Associates, LLC, Ms. Bailey served as Assistant Secretary for the Office of Policy and International Affairs of the U.S. Department of Energy from 2001 through February 2004. From February 2000 until May 2001, she was President and a director of PSI Energy, Inc., the Indiana electric utility subsidiary of Cinergy Corp. Prior to joining PSI Energy, Ms. Bailey was a Commissioner on the Federal Energy Regulatory Commission beginning in 1993. Ms. Bailey currently serves on the board of directors of Equitrans Midstream Corporation, a publicly-traded natural gas midstream company, PNM Resources, Inc., an investor-owned energy holding company and Battelle Memorial Institute, a private nonprofit

applied science and technology development company in Columbus, Ohio. Ms. Bailey previously served on the board of directors of EQT Corporation, a publicly-traded petroleum and natural gas exploration and pipeline company, from July 2004 to November 2018. In January 2010, Ms. Bailey was appointed as a member of the Secretary of Energy’s Blue Ribbon Commission on America’s Nuclear Future. She received a B.S. in Industrial Management from Purdue University and completed the Advanced Management Program at the Wharton School in 2013.

Skills and Qualifications:

Ms. Bailey has extensive knowledge of the energy industry, including significant experience with the Federal Energy Regulatory Commission, and government and public relations. She brings a diverse perspective to our Board based on her experience as a strategic consultant, a former energy executive and having served as Assistant Secretary for the Office of Policy and International Affairs.

NUNO BRANDOLINI MEMBER OF COMPENSATION COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE | AGE:65 DIRECTOR SINCE: 2000 | |||||

Nuno Brandolini is a member of our Compensation Committee and Governance and Nominating Committee. Mr. Brandolini was a general partner of Scorpion Capital Partners, L.P., a private equity firm organized as a small business investment company, until June 2014. Prior to forming Scorpion Capital and its predecessor firm, Scorpion Holding, Inc., in 1995, Mr. Brandolini served as Managing Director of Rosecliff, Inc., a leveraged buyout fundco-founded by Mr. Brandolini in 1993. Prior to 1993, Mr. Brandolini was a Vice President in the investment banking department of Salomon Brothers, Inc., and a Principal with the Batheus Group and Logic Capital, two venture capital firms. Mr. Brandolini began his career as an

investment banker with Lazard Freres & Co. Mr. Brandolini currently serves as a director of Lilis Energy, Inc., an oil and gas exploration and production company. Mr. Brandolini received a law degree from the University of Paris and an M.B.A. from the Wharton School.

Skills and Qualifications:

Mr. Brandolini brings a unique financial perspective to our Board based on his extensive experience as an investment banker and having actively managed private equity investments for approximately 20 years.

| 2019 PROXY STATEMENT | 13 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DAVID I. FOLEY DIRECTOR | AGE:51 DIRECTOR SINCE: 2012 | |||||

David I. Foley is a director of the Company. Mr. Foley is a Senior Managing Director in the Private Equity Group of The Blackstone Group L.P., an investment and advisory firm (“Blackstone”), and Chief Executive Officer of Blackstone Energy Partners L.P. Prior to joining Blackstone in 1995, Mr. Foley was an employee of AEA Investors Inc., a private equity investment firm, from 1991 to 1993, and a consultant with The Monitor Company, a business management consulting firm, from 1989 to 1991. Mr. Foley previously served on the board of directors of PBF Energy, Inc., from 2008 to 2014, Kosmos Energy Ltd., from 2004 to 2018, and Falcon Minerals Corp., from 2011 to 2018. Mr. Foley received a B.A. and an M.A. in Economics from Northwestern University and an M.B.A. from Harvard Business School.

Skills and Qualifications:

Mr. Foley brings industry expertise and a unique financial perspective to our Board based on his extensive experience having actively managed private equity investments for over 20 years. Mr. Foley’s appointment to the Board of Cheniere was made pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC, Blackstone CQP Holdco, LP (“Blackstone Holdco”) and various other related parties in connection with Blackstone Holdco’s purchase of Class B units in Cheniere Partners.

DAVID B. KILPATRICK MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE | AGE:69 DIRECTOR SINCE: 2003 | |||||

David B. Kilpatrick is a member of our Audit Committee and Compensation Committee. Mr. Kilpatrick previously served as our Lead Director from June 2015 to January 2016. Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry. He has been the President of Kilpatrick Energy Group, which invests in oil and gas ventures and provides executive management consulting services, since 1998. Mr. Kilpatrick served on the board of directors and as Chairman of the Compensation and Governance Committee of the general partner of Breitburn Energy Partners, L.P., a publicly traded MLP, from 2008 to 2018. Mr. Kilpatrick served on the board of managers of Woodbine Holdings, LLC, a privately held company engaged in the acquisition, development and production of oil and natural gas properties in Texas from 2011 to 2016. In May 2013, he was elected Chairman of the Board of Applied Natural Gas Fuels, Inc., a producer and distributor of liquefied natural gas fuel for the transportation and industrial markets, until the company was sold in 2018. He also served on the board of directors of

PYR Energy Corporation, a publicly-traded oil and gas exploration and production company, from 2001 to 2007, and of Whittier Energy Corporation, a publicly-traded oil and gas field exploration services company, from 2004 to 2007. He was the President and Chief Operating Officer for Monterey Resources, Inc., a publicly traded oil and gas company, from 1996 to 1998 and held various positions with Santa Fe Energy Resources, an independent oil and gas production company, from 1983 to 1996. Mr. Kilpatrick received a B.S. in Petroleum Engineering from the University of Southern California and a B.A. in Geology and Physics from Whittier College.

Skills and Qualifications:

Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry and brings significant executive-level and consulting experience in the oil and gas industry to our Board.

| 14 | CHENIERE | |||

DIRECTOR BIOGRAPHIES

ANDREW LANGHAM MEMBER OF COMPENSATION COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE | AGE:46 DIRECTOR SINCE: 2017 | |||||

Andrew Langham is a member of our Compensation Committee and Governance and Nominating Committee. Mr. Langham has been General Counsel of Icahn Enterprises L.P. (a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, mining, real estate and home fashion) since 2014. From 2005 to 2014, Mr. Langham was Assistant General Counsel of Icahn Enterprises. Prior to joining Icahn Enterprises, Mr. Langham was an associate at Latham & Watkins LLP focusing on corporate finance, mergers and acquisitions, and general corporate matters. Mr. Langham has been a director of: Welbilt, Inc. (formerly Manitowoc Foodservice, Inc.), a commercial food service equipment manufacturer, since 2016; and CVR Partners LP, a nitrogen fertilizer company, since 2015. Mr. Langham was previously a director of CVR Energy, Inc., a diversified holding company primarily engaged in the petroleum refining and nitrogen

fertilizer manufacturing industries, from 2014 to 2017; CVR Refining, LP, an independent downstream energy limited partnership, from 2014 to 2019; Freeport-McMoRan Inc., the world’s largest publicly traded copper producer, from 2015 to 2018; and Newell Brands Inc., a global marketer of consumer and commercial products, in 2018. Mr. Langham received a B.A. from Whitman College and a J.D. from the University of Washington.

Skills and Qualifications:

Mr. Langham brings a unique perspective to our Board based on his significant corporate governance, compliance, regulatory, finance and mergers and acquisitions expertise. Mr. Langham was initially appointed to the Board of Cheniere in accordance with a Nomination and Standstill Agreement that was entered into on August 15, 2015 by the Company, Icahn Capital LP and certain affiliates of Icahn Capital LP.

COURTNEY R. MATHER, CAIA, CFA, FRM MEMBER OF AUDIT COMMITTEE | AGE:42 DIRECTOR SINCE: 2018 | |||||

Courtney R. Mather, CAIA, CFA, FRM is a member of our Audit Committee. Mr. Mather has served as Portfolio Manager of Icahn Capital, the entity through which Carl C. Icahn manages investment funds, since December 2016, and was previously Managing Director of Icahn Capital from April 2014 to November 2016. Mr. Mather is responsible for identifying, analyzing, and monitoring investment opportunities and portfolio companies for Icahn Capital. Prior to joining Icahn Capital, Mr. Mather was at Goldman Sachs & Co. from 1998 to 2012, most recently as Managing Director responsible for Private Distressed Trading and Investing, where he focused on identifying and analyzing investment opportunities for both Goldman Sachs and clients. Mr. Mather has served as a director of: Caesars Entertainment Corporation, a global casino-entertainment and hospitality services provider, since March 2019; Newell Brands Inc., a manufacturer and distributor of a broad range of consumer products, since March 2018; Conduent Inc., a provider of business process outsourcing services, since December 2016; Herc Holdings Inc., an international provider of equipment rental and services, since June 2016; TER Holdings I, Inc. (formerly known as Trump Entertainment Resorts, Inc.), a company engaged in real estate holdings, since February 2016; and Ferrous Resources Limited, an iron ore mining company with operations in Brazil, since June 2015. Mr. Mather was previously a director of: Freeport-McMoRan Inc., the world’s largest publicly traded copper producer, from October 2015 to March 2019; Federal-Mogul Holdings Corporation, a supplier of automotive powertrain and safety components, from May 2015 to January 2017; Viskase Companies Inc., a meat casing company, from

June 2015 to March 2016; American Railcar Industries, Inc., a railcar manufacturing company, from July 2014 to March 2016; CVR Refining, LP, an independent downstream energy limited partnership, from May 2014 to March 2016; and CVR Energy, Inc., a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries, from May 2014 to March 2016. TER Holdings, Ferrous Resources Limited, Federal-Mogul, American Railcar Industries, CVR Refining, CVR Energy, and Viskase are each indirectly controlled by Carl C. Icahn. Mr. Icahn also has anon-controlling interest in each of Caesars Entertainment, Cheniere, Newell Brands, Conduent, Herc Holdings, and Freeport-McMoRan through the ownership of securities. Mr. Mather received a B.A. from Rutgers College, and attended the United States Naval Academy. Mr. Mather holds the Chartered Alternative Investment Analyst (CAIA), Chartered Financial Analyst (CFA), and Certified Financial Risk Manager (FRM) professional designations.

Skills and Qualifications:

Mr. Mather brings significant experience in finance to our Board and experience providing strategic advice and guidance to companies through his service as a director on various public company boards. Mr. Mather was initially appointed to the Board of Cheniere in accordance with a Nomination and Standstill Agreement that was entered into on August 15, 2015 by the Company, Icahn Capital LP and certain affiliates of Icahn Capital LP.

| 2019 PROXY STATEMENT | 15 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DONALD F. ROBILLARD, JR. CHAIRMAN OF AUDIT COMMITTEE | AGE:67 DIRECTOR SINCE: 2014 | |||||

Donald F. Robillard, Jr. is the Chairman of our Audit Committee. Mr. Robillard served as a director and the Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. (“Hunt”), a private holding company with interests in oil and gas exploration and production, refining, real estate development, private equity investments and ranching, from July 2015 until his retirement on January 31, 2017. Mr. Robillard began his association with Hunt in 1983 as Manager of International Accounting for Hunt Oil Company, Inc., a wholly-owned subsidiary of Hunt. Serving nine of his 34 years of service to the Hunt organization in Yemen in various accounting, finance and management positions, Mr. Robillard returned to the United States to join Hunt’s executive team in 1992. Mr. Robillard was named Senior Vice President and Chief Financial Officer of Hunt in April 2007. Mr. Robillard also served, from February 2016 through August of 2017, as Chief Executive Officer and Chairman of ES Xplore, LLC, a direct hydrocarbon indicator technology company which in 2016 was spun out of

Hunt. He is currently President of Robillard Consulting, LLC, an oil and gas advisory firm. Mr. Robillard is currently on the board of directors of Helmerich & Payne, Inc., a publicly-traded oil and gas drilling company, and the Board of Directors of Avalon Exploration and Production, LLC, a private oil and gas company. He is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants, the Texas Society of Certified Public Accountants and the National Association of Corporate Directors. Mr. Robillard received a B.B.A. from the University of Texas, Austin.

Skills and Qualifications:

Mr. Robillard has over 40 years of experience in the oil and gas industry and over 25 years of senior management experience. Mr. Robillard brings significant executive-level experience in the oil and gas industry, including experience with project financing for LNG facilities.

NEAL A. SHEAR CHAIRMAN OF COMPENSATION COMMITTEE | AGE:64 DIRECTOR SINCE: 2014 | |||||

Neal A. Shear is the Chairman of our Compensation Committee. Mr. Shear is Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP. Mr. Shear served as Interim Special Advisor to the Chief Executive Officer of Cheniere from May 2016 to November 2016 and as Interim Chief Executive Officer and President of Cheniere from December 2015 to May 2016. Mr. Shear was the Chief Executive Officer of Higgs Capital Management, a commodity focused hedge fund until September 2014. Prior to Higgs Capital Management, Mr. Shear served as Global Head of Securities at UBS Investment Bank from January 2010 to March of 2011. Previously, Mr. Shear was a Partner at Apollo Global Management, LLC, where he served as the Head of the Commodities Division. Prior to Apollo Global Management, Mr. Shear spent 26 years at Morgan Stanley serving in various roles including Head of the Commodities Division, Global Head of Fixed Income,Co-Head of Institutional Sales and Trading and Chair of the Commodities Business. He currently serves on the Advisory Board of Green Key Technologies, a financial Voice

over Internet Protocol (“VoIP”) technology company. Mr. Shear also serves as a director of Galileo Technologies S.A., a global provider of modular technologies for compressed natural gas and LNG production and transportation, since February 2017; Sable Permian Resources LLC, an independent oil and natural gas company focused on the acquisition, development and production of unconventional oil and natural gas reserves within the Permian Basin of West Texas, since May 2017; and Narl Refining Inc., the refining arm of North Atlantic Holdings St John’s Newfoundland, since November 2014. Mr. Shear received a B.S. from the University of Maryland, Robert H. Smith School of Business Management in 1976 and an M.B.A. from Cornell University, Johnson School of Business in 1978.

Skills and Qualifications:

Mr. Shear brings a unique financial and trading perspective to our Board based on his more than 30 years of experience managing commodity activity and investments.

| 16 | CHENIERE | |||

BOARD COMMITTEE MEMBERSHIP AND ATTENDANCE

The following table shows the fiscal year 2018 membership and chairpersons of our Board committees, committee meetings held and committee member attendance as a percentage of meetings eligible to attend. The current Chair of each Board committee is indicated in the table.

NUMBER OF MEETINGS HELD | BOTTA | FUSCO | BAILEY | BRANDOLINI | FOLEY | KILPATRICK | LANGHAM(1) | LIPINSKI(1) | MATHER(1) | ROBILLARD | SHEAR | ZICHAL(3) | ||||||||||||||

Audit | 9 | — | — | 89% | — | — | 89% | — | 100% | 100% | 100% Chair | — | — | |||||||||||||

Governance and Nominating | 5 | 100%(2) Chair | — | 100% | 80% | — | 100% | — | — | — | — | 100% | ||||||||||||||

Compensation | 6 | — | — | — | 83% | — | 100% | 100% | 100% | — | 100% Chair | 100% | ||||||||||||||

| (1) | In May 2018, Mr. Mather replaced Mr. Lipinski on the Board. |

| (2) | In August 2018, Mr. Botta was appointed Chair of the Governance and Nominating Committee. |

| (3) | In July 2018, Ms. Zichal resigned from the Board. |

The Board determines the independence of each director and nominee for election as a director in accordance with the rules and regulations of the SEC and the NYSE American LLC (“NYSE American”) independence standards, which are listed below. The Board also considers relationships that a director may have:

as a partner, shareholder or officer of organizations that do business with or provide services to Cheniere;

as an executive officer of charitable organizations to which we have made or make contributions; and

that may interfere with the exercise of a director’s independent judgment.

The NYSE American independence standards state that the following list of persons will not be considered independent:

a director who is, or during the past three years was, employed by the Company or by any parent or subsidiary of the Company other than prior employment as an interim executive officer for less than one year;

a director who accepts, or has an immediate family member who accepts, any compensation from the Company or any parent or subsidiary of the Company in excess of $120,000 during any period of 12 consecutive months within the past three years, other than compensation for Board or committee services, compensation paid to an immediate family member who is anon-executive employee of the Company, compensation received for former service as an interim executive officer provided the interim service did not last longer than one year, benefits under atax-qualified retirement plan ornon-discretionary compensation;

a director who is an immediate family member of an individual who is, or has been in any of the past three years, employed by the Company or any parent or subsidiary of the Company as an executive officer;

a director who is, or has an immediate family member who is a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments (other than those arising solely from investments in the Company’s securities or payments undernon-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years;

| 2019 PROXY STATEMENT | 17 | |||

GOVERNANCE INFORMATION

a director who is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the most recent three fiscal years any of the Company’s executive officers serve on the compensation committee of such other entity; or

a director who is, or has an immediate family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years.

As of February 2019, the Board determined that Messrs. Botta, Brandolini, Kilpatrick, Langham, Mather, Robillard and Shear and Ms. Bailey are independent, and none of them has a relationship that may interfere with the exercise of his or her independent judgment.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Board Leadership Structure. Mr. Botta serves as theNon-Executive Chairman of the Board. Mr. Fusco serves as President and CEO.

The Company has in place strong governance mechanisms to ensure the continued accountability of the CEO to the Board and to provide strong independent leadership, including the following:

theNon-Executive Chairman of the Board provides independent leadership to the Board and ensures that the Board operates independently of management and that directors have an independent leadership contact;

each of the Board’s standing committees, consisting of the Audit, Compensation and Governance and Nominating Committees, are comprised of and chaired solely bynon-employee directors who meet the independence requirements under the NYSE American listing standards and the SEC;

the independent directors of the Board, along with the Compensation Committee, evaluate the CEO’s performance and determine his compensation;

the independent directors of the Board meet in executive sessions without management present and have the opportunity to discuss the effectiveness of the Company’s management, including the CEO, the quality of Board meetings and any other issues and concerns; and

the Governance and Nominating Committee has oversight of succession planning, both planned and emergency, and the Board has approved an emergency CEO succession process.

The Board believes that its leadership structure assists the Board’s role in risk oversight. See the discussion on the “Board’s Role in Risk Oversight” below.

Non-Executive Chairman of the Board. TheNon-Executive Chairman of the Board position is held by Mr. Botta, an independent director. The Board has appointed an independent Chairman of the Board to provide independent leadership to the Board. TheNon-Executive Chairman of the Board role allows the Board to operate independently of management with theNon-Executive Chairman of the Board providing an independent leadership contact to the other directors. The responsibilities of theNon-Executive Chairman of the Board are set out in aNon-Executive Chairman of the Board Charter. These responsibilities include the following:

preside at all meetings of the Board, including executive sessions of the independent directors;

call meetings of the Board and meetings of the independent directors, as may be determined in the discretion of theNon-Executive Chairman of the Board;

work with the CEO and the Corporate Secretary to prepare the schedule of Board meetings to assure that the directors have sufficient time to discuss all agenda items;

prepare the Board agendas in coordination with the CEO and the Corporate Secretary;

advise the CEO of any matters that theNon-Executive Chairman of the Board determines should be included in any Board meeting agenda;

advise the CEO as to the quality, quantity, appropriateness and timeliness of the flow of information from the Company’s management to the Board;

| 18 | CHENIERE | |||

SHAREHOLDER OUTREACH–GOVERNANCE

recommend to the Board the retention of consultants who report directly to the Board;

act as principal liaison between the directors and the CEO on all issues, including, but not limited to, related party transactions;

in the discretion of theNon-Executive Chairman of the Board, participate in meetings of the committees of the Board;

in the absence of the CEO or as requested by the Board, act as the spokesperson for the Company; and

be available, if requested, for consultation and direct communication with major shareholders of the Company.

Board’s Role in Risk Oversight. Risks that could affect the Company are an integral part of Board and committee deliberations throughout the year. The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board consider the risks within their areas of responsibility. The Board and its committees receive regular reports directly from members of management who are responsible for managing particular risks within the Company. The Audit Committee discusses with management the Company’s major financial and risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. For a discussion of the Compensation Committee’s risk oversight, please see “Review of Compensation Risk” on page 26 of this Proxy Statement. The Board and its committees regularly discuss the risks related to the Company’s business strategy at their meetings.

SHAREHOLDER OUTREACH–GOVERNANCE

The Company proactively engages with shareholders on governance topics as a matter of strategic priority, and the continuous evolution of our governance framework is a product of the Board’s responsiveness to shareholder input.

Ahead of our 2018 Annual Meeting of Shareholders (the “2018 Annual Meeting”), members of our Board and management reached out to, and had extensive dialogue with, shareholders representing more than 50% of our outstanding common stock, through bothin-person and telephonic meetings.